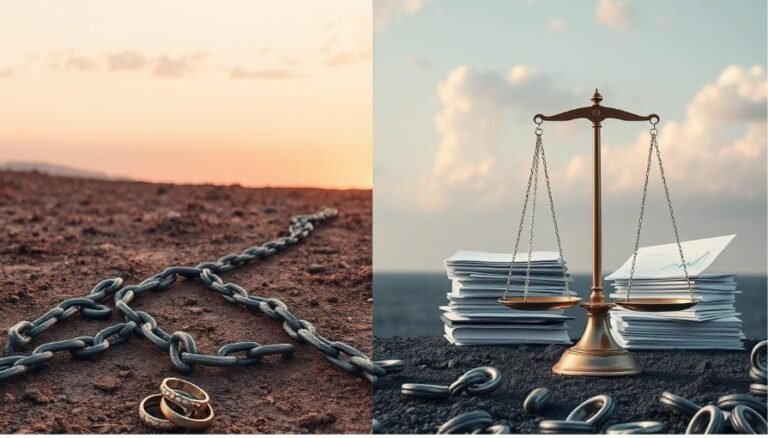

Going through a divorce is tough, especially when a business is involved. Getting business valuations right is key for a fair settlement and equitable asset division. This article will cover why professional appraisals matter, what affects a business’s value, the valuation steps, and how to pick the best appraiser. This will help protect your financial interests during a divorce.

Having a business in a divorce makes things more complicated. To get a fair settlement, you need a precise business valuation. This ensures both spouses get a fair share based on the company’s real value, not guesses or biased opinions.

It’s crucial to have skilled business evaluators involved, especially for unique industries like medical practices, tech start-ups, and big farms. They offer unbiased and detailed assessments. They consider things like double dipping and legal specifics that can change the asset division outcome.

Understanding Business Valuations in Divorce

In a divorce, the business owned by one or both spouses is seen as a marital asset. It must be divided fairly. Business valuations are key to this process. Experts use different methods to find the fair market value of the business.

They look at earnings, cash flow, intangible assets, market conditions, and ownership structure. This helps ensure assets are divided fairly.

The Importance of Accurate Valuations

The value of a business in a divorce depends on many things. Earnings and cash flow analysis are very important. A business’s value often depends on its ability to make money in the future.

Intangible assets like brand reputation and patents also play a big role. Market conditions and ownership structure can also affect the value. Legal issues, like contracts or disputes, can also impact the valuation.

When facing complex financial matters during divorce proceedings, seeking advice from Family Law Red Deer can help ensure that business valuations are handled fairly and in accordance with legal standards, protecting both your financial interests.

Factors Influencing Business Value

Getting the business valuations right is crucial in divorce. This is especially true for businesses with high value or complex structures. Disputes over the business’s worth also require accurate valuations.

For equitable asset division, the business’s value is determined by professional appraisals. This ensures a fair market value assessment. In most cases, a professional appraisal is needed, especially if the business is a big part of the marital assets.

Not every business needs a formal appraisal. This is true for very small businesses or when both parties agree on the value. Business valuations for divorces are done by experts like CPAs and certified analysts.

The Valuation Process

When a divorce involves a business, getting a skilled business appraiser is key. These experts, like CPAs, CVAs, or CFAs, use methods like income, asset, and market approaches. They aim to find the business’s fair market value. The appraiser’s skills and experience can make a big difference in the fairness of the valuation.

Choosing the Right Appraiser

Finding the right appraiser is crucial in the business valuation process. The appraiser’s professional expertise and experience in divorce-related valuations are vital. It’s important to pick someone qualified, like a CPA, CVA, or CFA, who knows the industry and market well.

Methods of Valuation

Business valuators use three main valuation approaches: income, asset, and market. The income approach looks at future earnings and cash flow. The asset approach values the company’s assets. The market approach compares the business to similar ones sold recently. By combining these methods, the appraiser can give a detailed and fair valuation.

The choice of valuation methods greatly affects the business’s value. It’s important to use multiple approaches for a fair and accurate assessment. The appraiser’s knowledge of the business’s unique factors, like industry trends and economic conditions, is crucial in picking the right methods.

Conclusion

Divorce rates in the United States are still high, with 50% of marriages ending in divorce. This rate has dropped from its peak in the late 1970s. Yet, the reasons for this trend, like more women working and accepting divorce, are still around.

Going through a divorce with a business involved is tough. But getting a fair business value is key to a good settlement. Knowing how to value a business helps protect your money and divide assets fairly.

Choosing the right appraiser is crucial for a fair business valuation in divorce. A good appraiser gives a detailed and accurate business value. This helps both sides make smart choices and reach a fair agreement. Taking care of this step helps protect your financial future and eases the emotional and financial stress of divorce.

FAQ

What is the importance of accurate business valuations in a divorce?

Accurate business valuations are key in a divorce. They help divide assets fairly. A business owned by one or both spouses is seen as a marital asset. It must be valued correctly during the division of assets.

What factors can influence the value of a business in a divorce?

Several factors can affect a business’s value in a divorce. These include earnings, cash flow, and intangible assets like brand reputation. Market conditions and the business’s ownership structure also play a role.

What are the main approaches used to value a business in a divorce?

To value a business in a divorce, several methods are used. The income approach, asset approach, and market approach are common. They look at future earnings, net asset value, and comparisons to similar businesses.

What qualifications should I look for in a business appraiser for a divorce?

When divorcing and a business is involved, choose a qualified appraiser. Look for a certified public accountant (CPA), certified valuation analyst (CVA), or certified financial analyst (CFA). They should have experience in divorce-related valuations.

How can choosing the right appraiser impact the accuracy and fairness of the business valuation in a divorce?

The right appraiser is crucial for a fair business valuation in a divorce. Their experience, qualifications, and knowledge of divorce valuations matter. A skilled appraiser can provide a detailed and fair valuation of the business’s worth.